What will the Referendum Cost Property Owners?

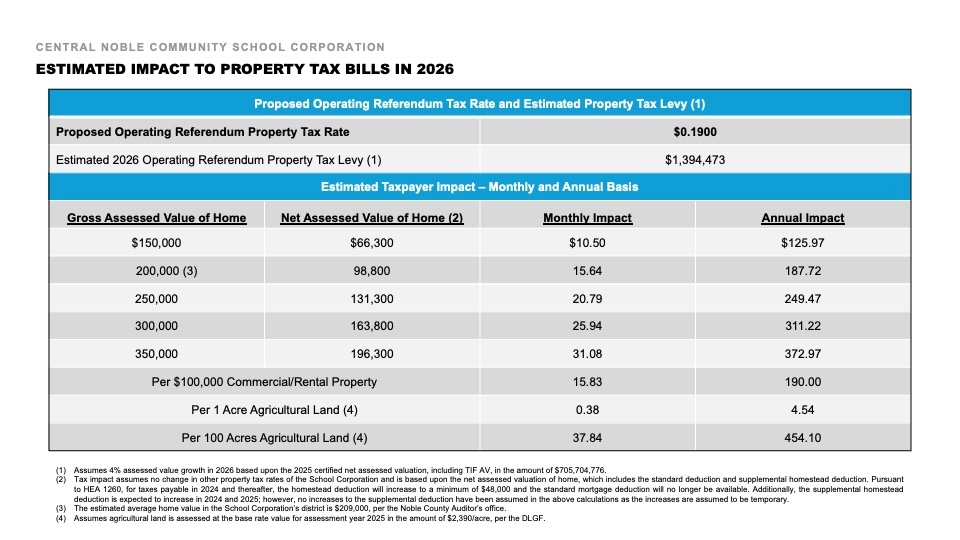

Central Noble Schools’ leadership has decided to pursue an operating referendum at a rate of $0.19 per $100 of a resident’s assessed property value—not the market value.

The average assessed home value in our community is $200,000, resulting in an increase of $15.64 per month ($187.72 annually) in the amount paid toward the school tax levy portion of property taxes.

To learn how much the operating referendum, if passed, will cost your household, use the Property Tax Impact Calculator developed by a third-party financial advising firm.

The Public Question is Misleading and Requires Clarification

Your property taxes will not increase by 29.7%.

Many experts and lawmakers indicate that the state mandated language used for the public question regarding the Central Noble schools’ referendum is misleading to voters. While the ballot question states an average increase of 29.7% on the school portion of property tax, the community needs to be aware that the state-mandated question does not reflect the reality of the real cost for property owners residing in the Central Noble school district.

The following is the public question regarding the Central Noble School Corporation’s operating referendum:

Shall Central Noble Community School Corporation increase property taxes paid to schools by homeowners and businesses for eight (8) years immediately following the holding of the referendum for the purpose of funding operating costs including funding increased utility costs, maintaining and expanding academic programs, recruitment and retention of teachers and staff, maintaining student safety and expanding security services, curriculum and other educational needs? If this public question is approved by the voters, the average property tax paid to schools per year on a residence would increase by 29.7% and the average property tax paid to schools per year on business property would increase by 23.7%?

Your property taxes will not increase by 29.7%. In reality, the majority of property owners in our community will experience an estimated increase of $15-$16 on the school tax portion of their monthly property tax bill. We encourage everyone to learn more about the actual impact to their property taxes by using the tax impact calculator (LINK) developed by a third-party financial advisor.